|

NAVIGATION

|

Your New Scoop SiteWelcome to Scoop! To help you figure things out, there is a Scoop Admin Guide which can hopefully answer most of your questions. Some tips:

For support, questions, and general help with Scoop, email support@scoophost.com ScoopHost.com is currently running Scoop version Undeterminable from . |

Tag: TAXESBy JGillman, Section News

Apparently, there is a caveat to recent 'good news' for the DIA.

Reposted from The Mackinac Center for Public Policy in time for Rick Snyder's State of the state address tonight:

Don't Bail Out Detroit with State Tax Dollars By Michael Lafaive By Michael LafaiveThe recent announcement that philanthropic foundations may donate $330 million to help the Detroit Institute of Arts, which would also help city pensioners avoid the consequences of Detroit government mismanagement, sounds like great news. Unfortunately, there may be a hook: A requirement that the state treasury contribute, which would convert voluntary private generosity into a coerced taxpayer bailout. A state bailout of Detroit is a terrible idea. It creates moral hazard and adds to the overly generous financial support the city has for years received from state taxpayers. And it's unfair. ~ Continued below the fold (4 comments, 722 words in story) Full Story By JGillman, Section News

Business is punished for operating in Michigan.

Its actually been punished in 39 states as of 2012 by way of personal property tax on business. Equipment, shelving, tools, furniture, etc..; bought, then taxed at 6%, then repeatedly taxed as 'wealth' like non-homesteaded property. In this way, business owners are told (as they are with smoking laws, work rules, and being converted to tax collectors) they really don't own JACK. None of it is under any absolute control, and frankly if the Business owner doesn't make a buck? They are still told to "Cough it up sunshine, you owe what you owe." Just for being here. And its not just the cost of having stuff laying around that punishes the Michigan entrepreneur. As is the case with many government rules, its the cost of compliance. The Tax Foundation writes: "TPP taxation is "taxpayer active," meaning that individuals and businesses must fill out tax forms listing all of their taxable personal property, adding a compliance cost to the total cost of administering personal property tax. This is in contrast to real property taxation, which is "taxpayer passive": a statement valuing the land, improvements, and property tax owed is sent to property owners, alleviating compliance costs while adding some cost for government to administer the tax."In a nutshell; "here are your manacles, make sure you clasp them securely around both ankles.." But relief could be in sight soon. The state of Michigan will have a surplus. "The Senate Fiscal Agency projected $1.3 billion in increased revenue over a May 2013 estimating conference. House Fiscal pegged the number at $1.1 billion, while Treasury offered a more conservative $708 million, citing uncertainty over unclaimed Michigan Business Tax credits."The conservative estimate might be light, but the $1.3 billion surplus estimate easily reaches the $1.2 billion in PPT revenues each year. Given the compliance costs can be transformed into profitable effort of growing business, and the added incentive for business attraction, (particularly to manufacturing and its associated equipment expenses) job growth could well explode going forward. Its time for legislators to step up, and do a wholesale elimination of what has been considered (2nd only to the repealed MBT) "the second dumbest tax in Michigan." (1 comment) Comments >> By Corinthian Scales, Section News

What better place can one possibly think of to promote the concept of "Free Monies" and a spiffy DIA tax advertisement than Washtenaw County's very own Moscow on the Huron.

As noted from WXYZ.

One of the team members tells 7 Action News that their professor even shed a tear while watching the ad. So did comrades Karl, Friedrich, and Vladimir Ilyich. By JGillman, Section News

This Is NOT Your Daddy's 'Paul' This Is NOT Your Daddy's 'Paul'Some of the ideas are familiar, but limited in ways typically embraced by establishment Republicans. Rand Paul's visit to Detroit was precipitated by a conference call being reported by the Detroit News. In it, Senator Paul speaks of enterprise zones, with taxes so low as to "bail yourselves out". Adding to this an loosened visa incentive for a flow of foreign "entrepreneurs" into the city. Paul, widely considered a 2016 potential presidential candidate, said he will introduce legislation Monday to create "economic freedom zones" by dramatically lowering taxes in depressed areas and loosen visa rules to encourage foreign entrepreneurs to immigrate to the city. So now instead of "jobs that Americans don't want to do," perhaps we will be talking about cities that Americans don't want to live or work in. I wonder how that would work? Maybe something like this? "Mr Chen, you are welcome to stay, invest, develop, and work in our country. However, you are limited to this particular region. If for some reason you are not satisfied there, I guess you are out of luck."Or in other words, "Welcome to the Hotel Detroit. Love it, or get the hell out of our country.."Right, somehow I can't see THAT happening. Which of course begs the question of what happens to those who emigrate, and decide to move somewhere a little safer than Baghdad of Michigan? When "loosening visa requirements," it seems that a genie let out is a little hard to stuff back in the lamp. Its hard to imagine 'restrictive' movement placed on those who simply seek a better life, and upon finding out that Detroit is no better than the hole they left, it is highly likely that they will indeed "seek" such a place. And it seems we have heard those words about foreigners feeling welcomed before. Go below the fold. (2 comments, 1894 words in story) Full Story By JGillman, Section News

Detroit has a little problem that is being addressed through management of existing resources.

The new Mayor and council however have a nearly impossible mission of making Detroit acceptable and inviting enough to attract new business and workers. Aside from the problem of the obvious social decay allowed for decades, there is a problem of theft by government. As the Mackinac Center rightly points out: ".. Michigan has been bailing out Detroit for years and it's only delayed the problems. In fact, Detroit gets favors from the state of Michigan that no other city receives, and the state has made these rules to try to get the city more revenue to deal with its problems.Add to a fumbling bureaucracy, and a (albeit a small one) personal income tax that gets residents nothing in return? Perhaps they should pay attention:

(1 comment) Comments >> By JGillman, Section News

The politics of parks in Michigan seems to be heating up.

Where else can the feel good elitist Lefties spend taxpayer money anymore with nary a peep from the paying-forever class. Parks programs are a great excuse to build dynasties, develop social connections, ensure a support base for political aspirees. But who can argue against the 'healthy impact' a strong parks and rec program has on your local community? The claims are ever-so-common, and made by those who operate such programs, yet would be hard pressed to prove such assertions if actually challenged. Mission creep within a department assigned to make accessible park and land resources owned by a local municipality, is near guaranteed when operators or directors discover the ultimate weakness of their Parks & Rec degrees. That a degree earned while squandering 4 to 6 years away in our taxpayer subsidized university systems has little to no value in the real world, except where people are too busy to note the difference between government programming and individual initiative. For SE Michigan, it will be ALL of Michigan's taxpayers who will be soon footing the bill for programming and access they will never use. In Grand traverse County, the political will to support such 'programming' in our parks is about to be tested. To which I say, "About damned time".

Go below the fold for the rest of the story. (3 comments, 1386 words in story) Full Story By JGillman, Section News

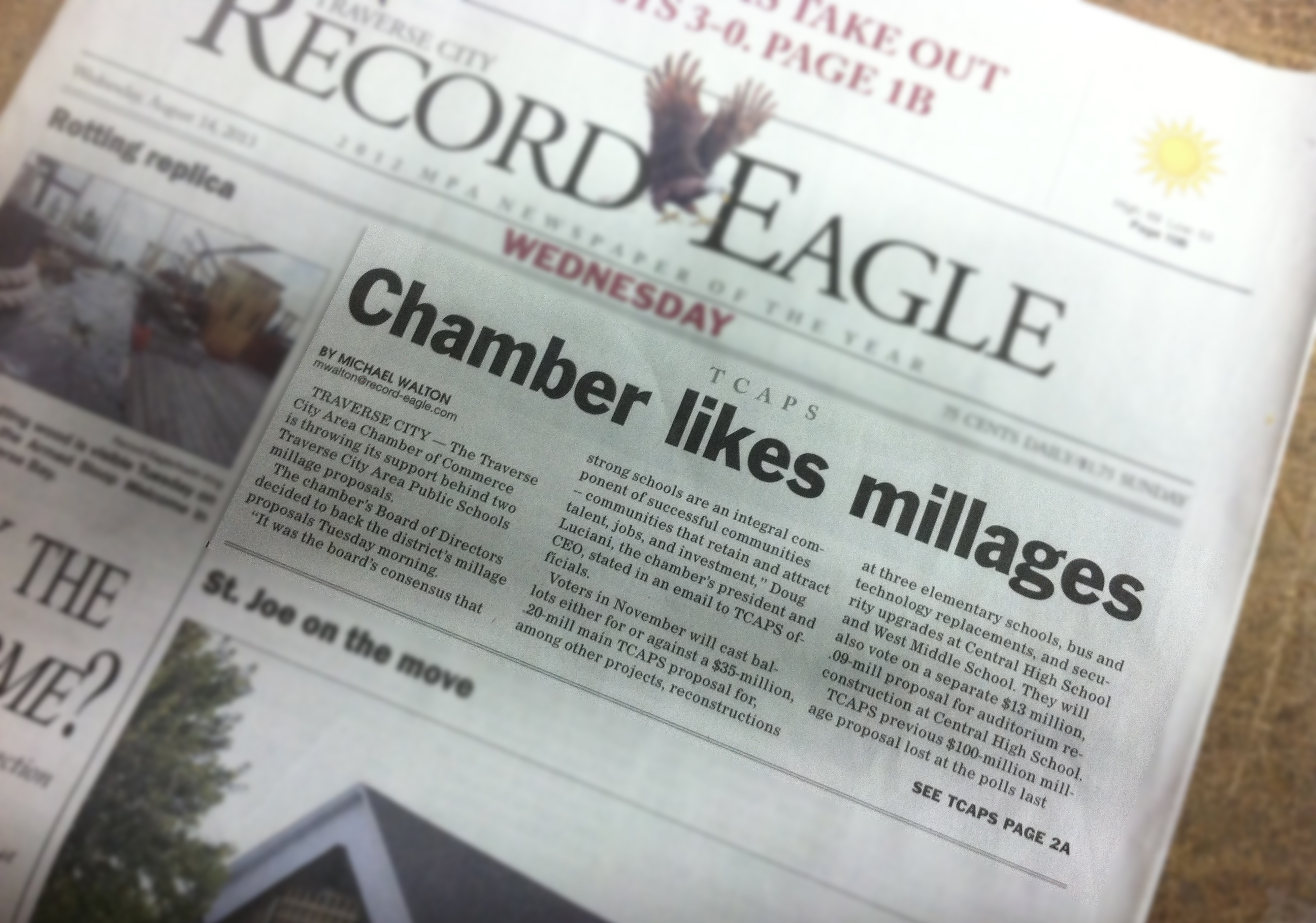

So said the headline August 14, 2013 on the front page of the Record Eagle in Traverse City. So said the headline August 14, 2013 on the front page of the Record Eagle in Traverse City.

It starts off: The chamber's Board of Directors decided to back the district's millage proposals Tuesday morning. I have saved that particular issue (and took the 1000 word photo) as a reminder of what happens when sleepy oversight meets an aggressive enemy, particularly in an advocacy organization. Today's chamber of commerce in particular is a far different creature than it once was. Traditionally an advocate of business and growth of a community by promoting lower cost of dealing with government, fewer regulations, and growing a customer base. The model has been altered by pro-regulatory, anti competitive and progressive high tax types who have infiltrated and merely put a face of business over their anti business operations. The article which spawned the headline touches on the example of the Traverse City Area Chamber of Commerce, and its support last year of a $100,000,000.00 boondoggle, and even more easily this year's reduced ($47,000,000.00 total) offering. It supports putting more of a burden on its members and those who bear the increasing liability of property ownership. taxable properties the school receives funding from has several classifications.

Estimated Taxable Value (ad valorem) $4,230,649,648.00, the Homestead Taxable Value is $2,518,975,070.00, leaving the Non-Principal Residence Exemption Taxable Value $1,711,674,578.00 or 40.5% of the taxable value is outside of homestead residential ownership. Remember those numbers highlighted above. And then continue on below the fold. (3 comments, 1219 words in story) Full Story By Republican Michigander, Section News

Things like this make me wish I still had my voter registration in Genoa Township instead of Green Oak. I don't like what they plan to do to my old neighborhood. My parents still live there and I still know most of the people there, many for 30+ years. This cuts across partisan lines here.

If you want to fix the roads with a millage, actually fix the roads. Don't add a bunch of new projects, especially those not wanted by the residents of the street who live there. Genoa Township has a new projects road millage on the ballot November 5th. It raises taxes 1.5 mills for 15 years. There is a blog site up giving several reasons to defeat the millage. Protect Genoa Township Neighborhoods. Organized opposition has been formed to oppose this millage. Protect Genoa Township Neighborhoods. PO Box 1182. Brighton MI 48116. So far enough money has been raised for a direct mail piece to likely voting households. AV mailing is out and another one is on the way. With more money, we can have signs and other GOTV efforts to defeat this thing. I'm consulting on this pro bono. This is "family business" to me and I'm not taking any cut from this project. There's some legitimate arguments both ways on a road millage IF (and that's a big if) it fixes existing main roads.You can argue jurisdictional issues, taxes, double taxation if Lansing interests get their gas tax or sales tax through, and cost/benefits there, but roads aren't in good shape. However, don't waste my parent's money and worse - don't wreck their neighborhood (1 comment, 1273 words in story) Full Story

|

External FeedsMetro/State News RSS from The Detroit News+ Craig: Cushingberry tried twice to elude police, was given preferential treatment + Detroit police arrest man suspected of burning women with blowtorch + Fouts rips video as 'scurrilous,' defends Chicago trip with secretary + Wind, winter weather hammer state from Mackinac Bridge to southeast Mich. + Detroit Cass Tech QB Campbell expected to be released from custody Friday + New water rates range from -16% to +14%; see change by community + Detroit's bankruptcy gets controversial turn in new Honda ad + Royal Oak Twp., Highland Park in financial emergency, review panels find + Grosse Ile Twp. leads list of Michigan's 10 safest cities + Wayne Co. sex crimes backlog grows after funding feud idles Internet Crime Unit + Judge upholds 41-60 year sentence of man guilty in Detroit firefighter's death + Detroit man robbed, shot in alley on west side + Fire at Detroit motel forces evacuation of guests + Survivors recount Syrian war toll at Bloomfield Hills event + Blacks slain in Michigan at 3rd-highest rate in US Politics RSS from The Detroit News + Apologetic Agema admits errors but won't resign + Snyder: Reform 'dumb' rules to allow more immigrants to work in Detroit + GOP leaders shorten presidential nominating season + Dems: Another 12,600 Michiganians lose extended jobless benefits + Mike Huckabee's comments on birth control gift for Dems + Granholm to co-chair pro-Clinton PAC for president + Republican panel approves tougher penalties for unauthorized early primary states + Michigan seeks visas to lure immigrants to Detroit + Peters raises $1M-plus for third straight quarter in Senate bid + Bill would let lawyers opt out of Michigan state bar + Michigan lawmakers launch more bills against sex trade + Balanced budget amendment initiative gets a jumpstart + Feds subpoena Christie's campaign, GOP + Poll: At Obama's 5-year point, few see a turnaround + Obama to release 2015 budget March 4 Front Page

Sunday January 19th

Saturday January 18th

Friday January 17th

Thursday January 16th

Tuesday January 14th

|