|

NAVIGATION

|

NEWS TIPS!RightMichigan.com

Who are the NERD fund donors Mr Snyder?Tweets about "#RightMi, -YoungLibertyMI, -dennislennox,"

|

Chamber LIKES MillagesBy JGillman, Section News

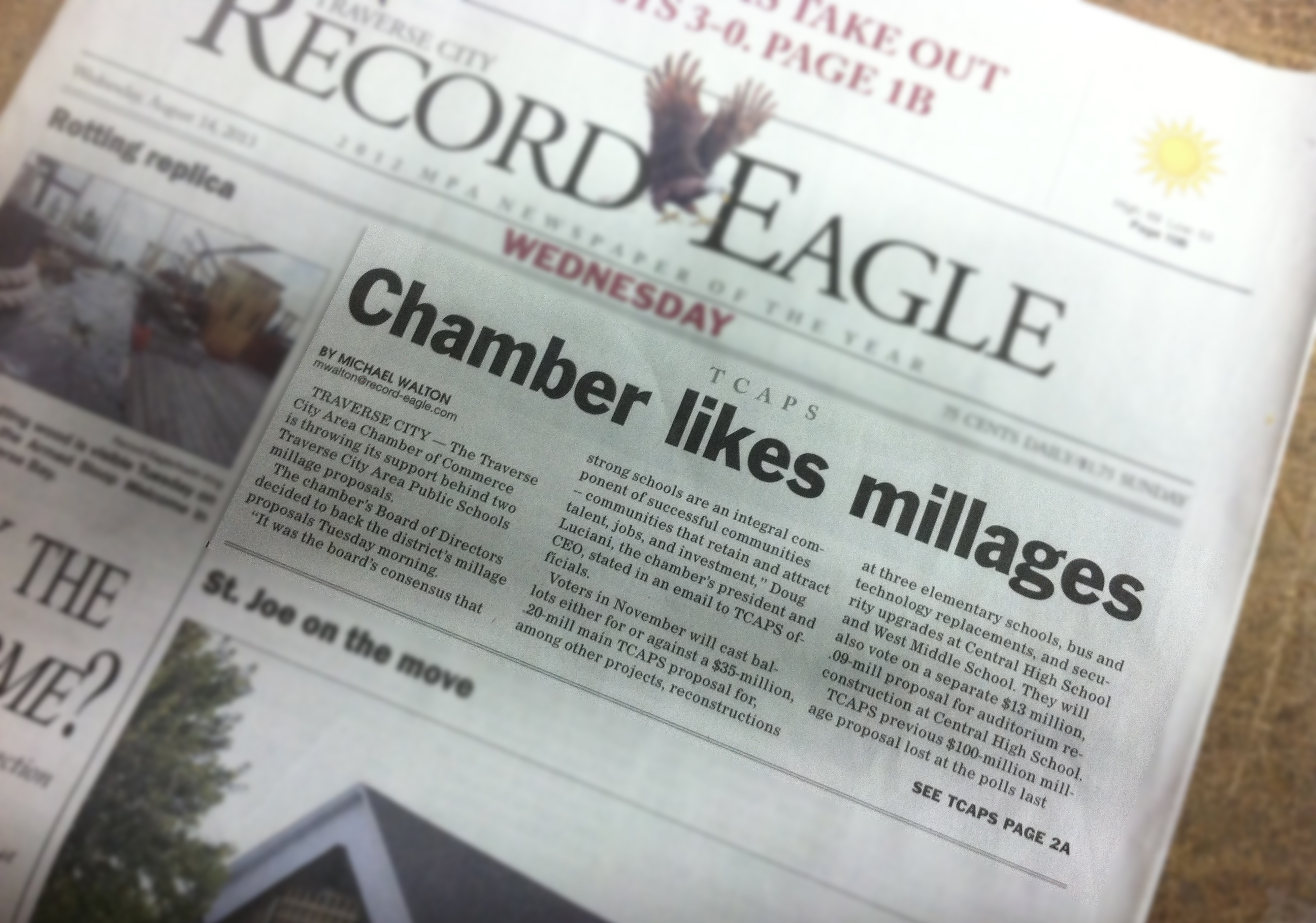

So said the headline August 14, 2013 on the front page of the Record Eagle in Traverse City. So said the headline August 14, 2013 on the front page of the Record Eagle in Traverse City.

It starts off: The chamber's Board of Directors decided to back the district's millage proposals Tuesday morning. I have saved that particular issue (and took the 1000 word photo) as a reminder of what happens when sleepy oversight meets an aggressive enemy, particularly in an advocacy organization. Today's chamber of commerce in particular is a far different creature than it once was. Traditionally an advocate of business and growth of a community by promoting lower cost of dealing with government, fewer regulations, and growing a customer base. The model has been altered by pro-regulatory, anti competitive and progressive high tax types who have infiltrated and merely put a face of business over their anti business operations. The article which spawned the headline touches on the example of the Traverse City Area Chamber of Commerce, and its support last year of a $100,000,000.00 boondoggle, and even more easily this year's reduced ($47,000,000.00 total) offering. It supports putting more of a burden on its members and those who bear the increasing liability of property ownership. taxable properties the school receives funding from has several classifications.

Estimated Taxable Value (ad valorem) $4,230,649,648.00, the Homestead Taxable Value is $2,518,975,070.00, leaving the Non-Principal Residence Exemption Taxable Value $1,711,674,578.00 or 40.5% of the taxable value is outside of homestead residential ownership. Remember those numbers highlighted above. And then continue on below the fold.

I was able to take a couple of reports and worksheets to work backward to build a numbers and percentage breakout for a better explanation of what is involved in the TCAPS issue over the last couple years.

The county equalization makeup is pretty close to the school district's, but because the density of Traverse City immediate area is greater than other outlying areas in other districts, there is a higher concentration of commercial, industrial, and dense residential (non homestead) tax base. To start, we will use the percentage breakdown used in the last equalization report to the Grand Traverse county board of commissioners.

The district overlaps in a couple of areas and is very similar. The ACTUAL School percentages calculated from one of the county's taxable by district worksheets corrects for the density

The bottom line? Its non-homestead residential including managed business properties as well as second home non exempt status. Its commercial and industrial, as well as personal property taxes bearing the brunt of school funding. BUSINESS, is the encumbered resource here already. One would think that local chambers would be a little more sensitive to that fact. Especially before advocating an increase to the cost of doing business like a $100,000,000.00 bond issue as was done in 2012. Never mind the fact that the School district was using a trick, and asking for that monster bond to work with the 2007 bond request of the same amount. The claim "only 0.8mil will be added" to the bill was correct, but by itself over ten years would only cover about $33.8 million for bond repayment based on the taxation. The TOTAL amount approved would have amounted to $165,000,000.00 because of an as yet unused $65,000,000.00 that remained approved from 2007's ballot question; a bond approval that would have expired, and relieved taxpayers after 2017. The existing 3.1 mil was going to provide the needed revenue to pay for the remaining approved, however adding just the measly little 0.9mil for something 'special,' and the entire trick @ 3.9 mil would have provided $164,995,336.00 over the ten year NEW approval, assuming ad valorem property values remain flat in that time. Clever. And the chamber ignoring this, not only failed to consider what it meant for its business taxpayers, but eagerly jumped on board and touted how its cost "would be only $67 more per average household," speaking for people it does not represent. Chamber representatives went from radio show to radio show, public square meeting to public square meeting, shoulder to should with school officials, talking about how all that money would mean jobs and literally saying that there would be "something for everyone!" Classic. But they didn't talk about the already heavy load on business. They didn't pass along the danger of taking an additional $100,000,000.00 over that ten year period from the local economy to pay for the promise of jobs. They didn't remember that 40.5% of the money raised comes DIRECTLY from BUSINESS in the taxing district; that $4,000,000 a year is money not spent on business expansion, repair, retrofits, and payroll. The other near 60 %, coming from people who by default have a zero-sum game they must play; one that forces them to conserve in one area as the others become inflated. Clueless. This local chamber, like many others throughout the state and country, have attracted operators who don't understand the REAL mechanics of small business or free enterprise. It has pledged itself to the destruction of business growth and prosperity in its operating area. It has abandoned advocacy AGAINST such business killing efforts as higher taxes in favor of 'investments' in non-business accoutrements. It has supported the never ending trickery of ever-growing government and its severely progressive operations. It says this year the schools have "listened to the voters," by asking for about half of last year's amount. And that makes it OK.

Because the chamber likes millages.

Chamber LIKES Millages | 3 comments (3 topical, 0 hidden)

Chamber LIKES Millages | 3 comments (3 topical, 0 hidden)

|