|

NAVIGATION

|

NEWS TIPS!RightMichigan.com

Who are the NERD fund donors Mr Snyder?Tweets about "#RightMi, -YoungLibertyMI, -dennislennox,"

|

Lies, Damned Lies, and "Defend Michigan Democracy"By Kevin Rex Heine, Section News

A "Red Herring" fallacy (also known as an "irrelevant conclusion" fallacy) is a logical error in which an argument is, intentionally or not, constructed of irrelevant or false inferences, with the intention of masking the lack of substantive arguments and/or implicitly replacing or diverting attention away from the actual subject of the discussion, by proving a different proposition than the one it is purporting to support. And I can tell you that defending Proposal 12-5 out in the social media sphere has been an education in countering Ignoratio Elenchi.

In my previous article on this topic I mentioned that the fight to get the Michigan Two-Thirds Taxation Amendment passed this year is not that different from the fight to get the Michigan Civil Rights Initiative passed six years ago, and those familiar with both campaigns with whom I have spoken support that conclusion. Granted, MAP, AFP-MI, and their allies aren't being subjected to physical violence or death threats, but other than that the misrepresentations and outright distortions, bandwagon arguments, and internal division within the MIGOP on this matter are eerily similar. . .

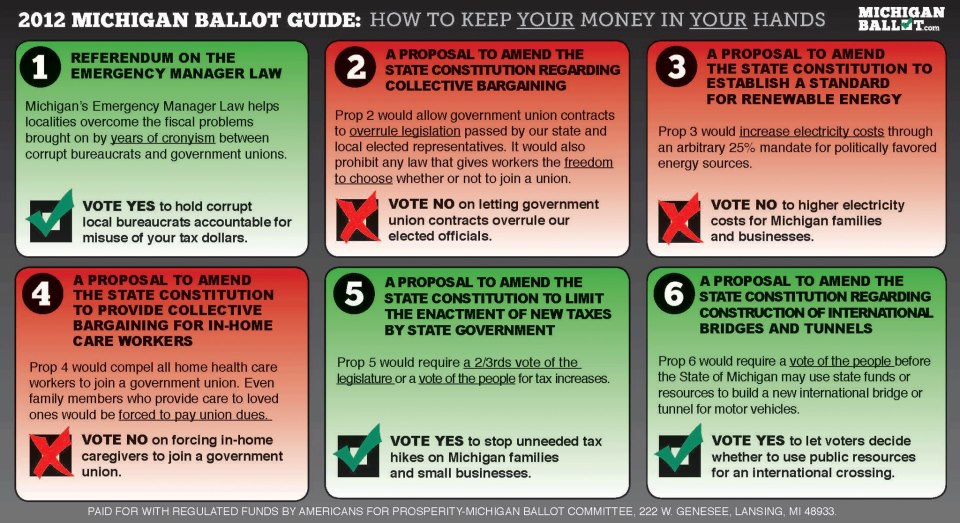

So far as I know, every single major newspaper in this state (including the entire mLive network) has endorsed the Governor Snyder's "1 is a yes, no on the rest" meme (which he's supporting with a "privately funded" bus tour around the state that is occasionally meeting up with resistance, which may be why he prefers behind-closed-doors venues). Lieutenant Governor Calley has, unsurprisingly, released his own series of video recommendations on the proposals. The Michigan Republican Party couldn't be bothered to consider the matter at their state convention back in September (though it is in the national party platform and is consistent with the core party principles), and several tea party leaders (including Darlene Thompson and Ken Ration out of Ionia County and Gene Clem out of Kalamazoo County) seem to be out in front in the grassroots effort to kill this proposal. I mean, if you were to believe the "Defend Michigan Democracy" website, and especially their "DefendMIDemocracy" YouTube channel, you'd think that everyone of any importance in Michigan thinks that the Two-Thirds Movement is going to torpedo Michigan's economic recovery, so it must be a bad idea. Except that not everyone's on board, and that includes not everyone who's influential in Michigan republican politics. Consider that these people and organizations are on-the-record as supporting a "yes" vote on Proposal 12-5:

Another line frequently being spouted on this is that Proposals 2 through 6 are all constitutional amendments, and will be difficult to update in the future to address changing conditions; thus we should avoid locking these proposals into the Michigan Constitution. This is a perversion of the Citizens Protecting Michigan's Constitution message, which is focused on proposals 2, 3, and 4. As I discussed in an article published about a week ago, the Two-Thirds Taxation Amendment is a legitimate use of the Article XII process. Major kudos to Nick DeLeeuw, CPMC Spokesman, for getting the "hands off our constitution" message to resonate with the statewide electorate; but dude, I think you did your job a little too well. I find it just a tad puzzling that Bill McMaster, the State Chairman of Taxpayers United Michigan Foundation, formed to support and defend the Headlee Amendment, would issue a press release claiming that Proposal 12-5 undermines Headlee and is fatally flawed on that basis. But according to the Michigan Supreme Court, in their September 5th decision, that's not so (emphasis in original):

... this would not be an alteration or abrogation of article 9, § 26 of the 1963 Michigan Constitution. Instead, it is a proposal that places the proposed amendment in a particular, chosen place in the Constitution, and in doing so takes advantage of terms and definitions that apply only to a certain range of sections. However, it would neither alter nor abrogate § 26. ... The Headlee Amendment itself, just so we're clear, currently deals principally with local taxation. Where it does deal with state taxation, it places limits on the Total State Revenue (all sources save federal aid) that the state may collect in any fiscal year. The reason that Proposal 12-5 amends Headlee (specifically, Article IX § 26) is so that it can take advantage of the definitions applicable to Headlee (as specified in Article IX § 33), and apparently also to expand the Headlee protection to all state taxation. The full petition text transcript makes it pretty clear that the additional hurdles Proposal 12-5 adds to Headlee are, while broadly applicable to all state taxation, nevertheless limited in scope. It doesn't prevent shrinking an existing tax base, reducing an existing tax rate, or repealing a tax altogether; so the claim that Prop 5 wouldn't have prevented the MBT repeal, will make it harder to provide net reductions in taxes, or reform government overall is so much hogwash. The only budget reforms that Snyder couldn't have enacted last year would have been those that violate the plain language of the amendment. A repeal-and-replace bill that swapped the MBT for the CIT should be allowable under 2/3; expanding the state income tax to include pensions may be a different matter. Because of the balanced budget requirement of Article V § 18, government reforms would have involved using actual cuts to balance the state budget, not playing a shell game with the tax structure. According to a Defend Michigan Democracy ad spot, Proposal 12-5 will, if passed, result in funding cuts to education, public safety, or infrastructure projects because the legislature won't be able to balance the budget, and the counties will have to raise property taxes to cover the gap. Yes, they're actually using the human shields argument, with a twist. The unions that dumped a total of $710,000 into the "vote no on 5" campaign a week ago stand to lose a great deal of bargaining leverage when the Two-Thirds Taxation Amendment forces the governor and the legislature to actually start cutting the waste out of the state spending, including pink-slipping employees who don't need to be on the state payroll, or tying school funding to realistic performance metrics. And you can bet your sweet bippy that the first time they force the legislature to put a proposed tax hike on the November ballot, the human shields advertising will make the combined efforts to sell proposals 2, 3, & 4 (and kill 5 & 6) look tame in comparison. Another beauty is the assertion that 13 state senators are all that will be needed to block any tax legislation; that small a number can be easily bought, allowing lobbyists to protect their clients' tax carve-outs. First, keep in mind that this is being advanced by the Defend Michigan Democracy crew and their surrogates, probably to deliberately incite a class warfare argument. If it's not okay to use the "close the loophole" argument to expand the state income tax to senior citizen pensions, then it isn't okay to use that argument to eliminate business tax exemptions (assuming that any exist in the first place). On the other hand, if we do accept their premise, then I suppose that the military pay-and-pension exemption will be the next one to go with regard to the state income tax . . . I'd like to see the governor sell that one. This "super minority" argument is being used to play on the manufactured apprehension of a do-nothing legislature. A mere baker's dozen of state senators will be enough to gridlock the state legislature, so nothing will get done. First, the "gridlock argument" ignores that the actual limitation of the Two-Thirds Taxation Amendment, while formidable, is actually limited in scope. Second, a little legislative gridlock isn't necessarily a bad thing; we shouldn't forget Mark Twain's admonishment that while the legislature is in session, no one's life, liberty, or property is safe. I prefer to think of that "super minority" as a constitutional firewall protecting my wallet. A variant on the "super-minority" argument is that only a handful of states have super-minority requirements, and they tend to be poor, or have struggling economies and ongoing state budget crises. Their "examples in evidence" are California (which chronically fails to balance the state budget), Nevada (currently the highest unemployment rate in the nation), and Mississippi (the poorest state in terms of per capita income). They also cite Arizona, Colorado, Delaware, Louisiana, Oregon, and Washington as examples of supermajority states with economic issues. First, I'd love to know what the connection is between unemployment and tax policy, because Nevada's 2/3 supermajority requirement was approved by the statewide electorate in 1996, but they didn't become the state with the highest unemployment rate until February of 2010 (replacing Michigan, I think). Definitely, this is a non sequitur, unless there's a connection there that I'm just not seeing. Second, I'll grant that Mississippi does have the lowest per capita income in the country, but it also has the 16th lowest cost-of-living and the 17th lowest overall tax rate . . . so a little goes a long way. And again, I'm not seeing the connection, because so far as I'm aware, the Hospitality State has always sat at or near the bottom of the per capita income pile, but have only had a 3/5 supermajority requirement since 1970. Again, I'm not seeing the connection. Third, California is a whole different ball of wax. Infrastructure (including roads) construction and repair projects are exempt from the state's constitutional limitations on spending. According to the state constitution, bond debt to fund those projects must be ratified by the state electorate, and usually is. (Note that the most voluminous year for ballot proposals under Michigan's current constitution - 11 of them in 1978 - is a normal year in California.) And yet Defend Michigan Democracy blames California's budget gridlock and chronically dysfunctional government on a constitutional taxation limitation (because that must be the problem). According to the Center for Fiscal Accountability, there are sixteen states that currently have some form of supermajority requirement to raise taxes. With regard to overall tax climate, cost of living index, bond ratings, and yes even per capita personal income, these states are all over the chart. However, Randy Bishop recently did some research for his radio show, and learned that states with this measure in place typically have revenue streams so stable that they can project their budgets at least two years in advance. That's no small matter, and I suspect that a stable revenue stream, coupled with a mechanism to maintain a balanced budget and a plan to pay off the state's debt (that, to Snyder's credit, is actually working) should continue to improve Michigan's credit rating. Herman Cain is fond of citing the rhetorical tactics of the liberals as "S-I-N tactics." They prefer to Shift the subject and Ignore the facts. But if neither of those tactics work, if you can pin down their arguments to the point that they have no escape, then they will default to Name calling. (This, of course, is when Margaret Thatcher starts rejoicing.) The same is true here, and I've been dealing with it in social media for the past eight weeks, especially with tea partiers of all people. Successfully rebut every single fallacious argument, pin them rhetorically on every single point, and the next thing you know . . . wait for it . . . the Moroun family fortune is bankrolling this proposal, so even though it looks like a good idea, there's got to be a hidden agenda, and we shouldn't be encouraging the mob rule of direct democracy anyway. Okay, I'm all a fan of statutorily raising the bar on the citizen initiative as high as Article XII § 2 will allow (and I was talking with a state senator about this a couple of weeks ago), but disagreeing with the method by which a proposal made it to the ballot is no excuse for refusing to consider the measure on its merits. And as for the Moroun family and hidden agendas, just try to explain as a rebuttal the public-sector union money bankrolling the "no on 5" campaign or the fact that the GoverNerd is "stretching the law to its limit" (Mark Brewer's words) and getting away with using the perks of the office to push his position on the ballot proposals. Assuming that your rebuttal is even acknowledged, it won't matter. Because Matty Moroun is a multi-billionaire and is personally funding two proposals, they must be somehow connected to each other, and he must have some ulterior motive. Class warfare, tea party style. All red herrings aside, according to Michael LaFaive at the Mackinac Center, "Proposal 5 is arguably the most straightforward of all the proposals on the Nov. 6 ballot." As with MCRI, both the kakistocracy establishment and the kleptocracy establishment have to muddy up the waters, because they lose if they start discussing this on its merits. Put the brakes on runaway state taxation, enough spending, it's not rocket science, you decide . . . YES ON FIVE!!!

Lies, Damned Lies, and "Defend Michigan Democracy" | 1 comment (1 topical, 0 hidden)

Lies, Damned Lies, and "Defend Michigan Democracy" | 1 comment (1 topical, 0 hidden)

|

Related Links+ previous article on this topic+ Michigan Two-Thirds Taxation Amendment + every single major newspaper in this state + 1 is a yes, no on the rest + privately funded + meeting up with resistance + behind-clo sed-doors venues + his own series of video recommendations + national party platform + core party principles + Defend Michigan Democracy + DefendMIDe mocracy + everyone of any importance in Michigan + Two-Thirds Movement + Gadarene Swine Fallacy + Citizens Protecting Michigan's Constitution + article published about a week ago + Two-Thirds Taxation Amendment + Article XII process + Taxpayers United Michigan Foundation + issue a press release + in their September 5th decision + Headlee Amendment + specifical ly, Article IX § 26 + as specified in Article IX § 33 + full petition text transcript + Article V § 18 + a Defend Michigan Democracy ad spot + dumped a total of $710,000 into the "vote no on 5" campaign + only a handful of states have super-minority requirements, and they tend to be poor, or have struggling economies and ongoing state budget crises + bond debt to fund those projects + because that must be the problem + sixteen states that currently have some form of supermajority requirement + overall tax climate + cost of living index + bond ratings + per capita personal income + is actually working + Article XII § 2 + Michael LaFaive + Mackinac Center + enough spending + not rocket science + you decide + YES ON FIVE + + Also by Kevin Rex Heine |